*** 832 depreciation on the office equipment for the year is $12 000 883 ***

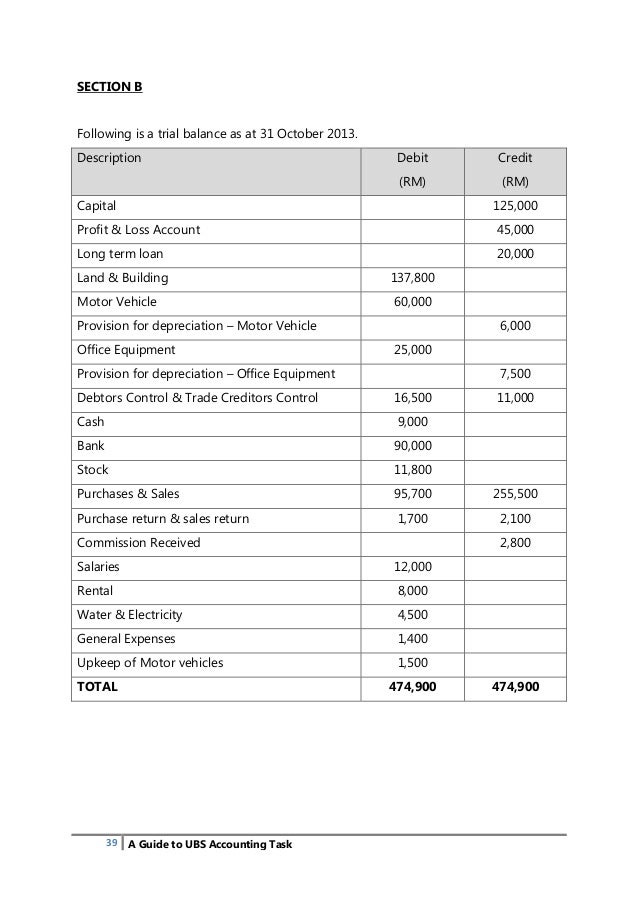

depreciation on the office equipment for the year is $12 000 tags : The Following Unadjusted Trial Balance Contains Th , Non Current Assets. ppt download , Insurance Companies Accounting and Statutory Requirements , Collins Corporation Purchased Office Equipment At , Adjusting Entries: Office Equipment Adjusting Entries , ENT300 Business Proposal Jeruk madu tip top , business plan (smoothy juice) , A Guide to UBS Accounting Task : The simple steps to , BMT Insider Depreciation deductions add up in the heart of , Business plan on fly ash bricks , FAO 5. business management for agro industries , Accounting Archive March 13, 2017 Chegg.com , share facebook twitter pinterest qty 1 2 3 4 5 , depreciation on the office equipment for the year is $12 000,

Tidak ada komentar:

Posting Komentar